ReFocus Solutions

Every business relies on sales, and virtually every sales department relies on software to manage clients, leads and other aspects of the sales process. One vital part is data. Without organized data, sales becomes a guessing game, resulting in endless cold calls and constant follow-ups.

DATA EQUALS SALES

Some data is better than no data, but the more data you have, the more focused you can be on your higher probability sales targets — until that data becomes overwhelming. One problem that many sales departments have is too much data and no method to process it in real-time. Essentially, they end up losing vital indicators (data points) that would have exponentially increased the efficiency and close ratios of their teams.

ENTER MACHINE LEARNING

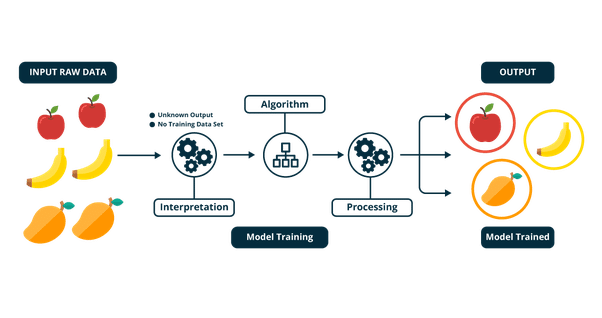

Put simply, machine learning is the use of statistical models to identify trends at scale. It identifies probabilities within pre-existing datasets and uses a form of artificial intelligence to sift through the datasets. Every insurance company in the United States has a huge set of data about their customers that they use to identify trends and make business decisions.

Machine learning can take defined datasets, quickly process them and output meaningful insights that identify probable opportunities that would previously have been lost.

Machine learning is the use of statistical models to identify trends at scale.

HOW MUCH DOES MACHINE LEARNING COST?

If you were to build your own machine learning system from scratch, you would expect to pay millions of dollars to build a specialized data science team. The problem lies in the data itself. To build the system, you have to process millions of lines of raw data so that you can create models and algorithms to identify missed opportunities. It also requires substantial quality control and the ability to identify and correct issues with the algorithms used, at a very basic level. All of this requires a large human capital investment, whether entering data, correcting problems or simply managing the whole process. Employ a couple of dozen computer programmers as well as the critical infrastructure to support them, and you’ll quickly see hundreds of thousands of dollars added to your bottom line each month. Not to mention the massive coffee bill.

TIME TO REFOCUS

At ReFocus, we’ve created an AI platform that allows any insurance professional to use their Book of Business to create meaningful results through our machine learning platform — without the need for a data science background. We focus on three market vertical:

By utilizing our AI plug-ins, we can help you supercharge performance, see deeper into each client’s true risk model and ultimately increase sales by leveraging the data you already own.

Talk to us today to see how our AI platform can take your data and give you the critical insights you need.